North Texas auto title loans offer quick cash for car owners with substantial equity, providing a simple process and flexible terms compared to traditional banking. With no credit checks, these loans cater to diverse borrowers but carry significant risks. High-interest rates and potential hidden fees may trap borrowers in debt. To avoid this, careful review of loan terms, credit checks, and understanding the implications of refinancing are crucial before taking out a North Texas auto title loan.

In the vibrant, bustling landscape of North Texas, understanding auto title loans is crucial for navigating financial challenges. This article demystifies these short-term lending options specifically tailored to residents here. We’ll explore what constitute North Texas auto title loans, delve into the renewal process and its requirements, and critically examine the costs and risks involved. By the end, folks will be equipped to make informed decisions about this game-changer for immediate financial relief.

- What Are North Texas Auto Title Loans?

- Renewal Process and Requirements

- Understanding the Costs and Risks of Auto Title Loan Renewals in North Texas

What Are North Texas Auto Title Loans?

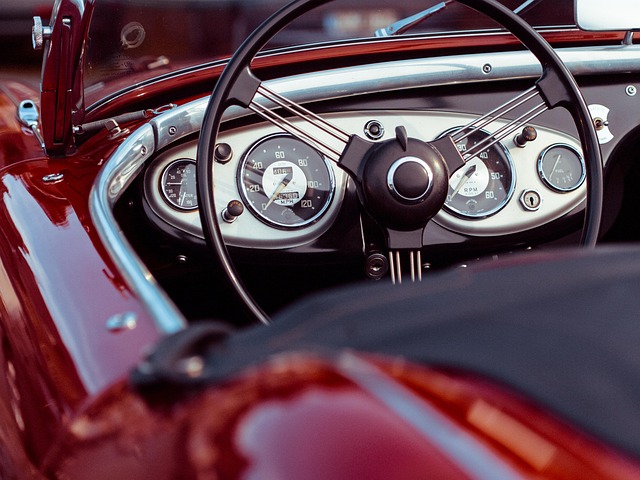

North Texas auto title loans are a financial solution where individuals can use their vehicle’s title as collateral to secure a loan. This type of loan is specifically designed for those who may need quick access to cash and have a car with substantial equity. It offers a straightforward process, allowing borrowers to obtain funds by providing the title of their vehicle. Once approved, they can drive off with much-needed money, paying it back in installments over a set period.

Unlike traditional loans that often require a thorough credit check, North Texas auto title loans cater to a wide range of borrowers, including those with less-than-perfect or no credit history. This alternative lending option is particularly appealing as it provides faster funding and more flexible terms, making it accessible for many residents looking to bridge financial gaps without the stringent requirements typically associated with bank loans, including strict interest rate structures and extensive documentation.

Renewal Process and Requirements

When it comes to renewing a North Texas auto title loan, the process is designed to be straightforward and efficient. Borrowers need to initiate the renewal by contacting their lender or visiting their office to express their intention to extend the loan term. This initial step involves providing valid identification, proof of insurance, and verifying the condition of the vehicle that serves as collateral for the loan.

The lender will then assess the current market value of the vehicle and compare it with the outstanding balance on the existing loan. If the vehicle’s value has increased since the original loan approval (commonly referred to as Fort Worth loans), borrowers may have the option to roll over the existing loan into a new title loan with potentially different terms, ensuring they continue to own their vehicle while managing their finances effectively within the North Texas auto title loans framework.

Understanding the Costs and Risks of Auto Title Loan Renewals in North Texas

When considering North Texas auto title loans, understanding the costs and risks associated with loan renewals is essential. These short-term lending options are designed for immediate financial needs but can quickly turn into a cycle of debt if not managed properly. The primary risk lies in the high-interest rates and potential hidden fees that come with these loans. Lenders often offer convenient access to funds by using your vehicle’s title as collateral, but this means you’re risking losing your asset if you fail to repay on time.

One common practice in North Texas is loan refinancing, where borrowers opt for a new loan to pay off the existing one. This might seem like a solution to manage monthly payments, but it could result in longer repayment periods and even higher overall costs. A thorough understanding of the terms, including interest rates, fees, and repayment conditions, is crucial before agreeing to any North Texas auto title loans renewal or refinancing option. Additionally, avoiding impulsive decisions by conducting a credit check to assess your financial standing can help prevent falling into a debt trap.

In understanding North Texas auto title loans, it’s crucial to grasp both the renewal process and associated costs. This article has illuminated the requirements for renewing these loans, emphasizing transparency in terms and conditions. By recognizing the potential risks, borrowers can make informed decisions regarding this short-term financing option in North Texas. Remember that while auto title loan renewals offer a temporary solution, it’s essential to explore alternative options for long-term financial stability.